Changes to the Council Tax Reduction Scheme 2020/21

Ashford Bourough Council

Opens: 01 August 2019

Closes: 30 September 2019

What is this consultation about?

Each year the Council has to decide whether to change the Council Tax Reduction scheme for working age applicants in its area. This year the Council has decided that changes should be made to significantly change the Council Tax Reduction scheme. This is due to the introduction of Full-Service Universal Credit within the Ashford area. In effect the traditional link between Housing Benefit (which will no longer be available to new working age claimants, with some exceptions) and Council Tax Reduction will no longer exist. It is essential that the scheme is changed to meet future requirements, to reduce the cost of running the scheme and to ultimately prevent any additional costs being added to Council Tax.

Please note that whilst the changes are intended to reduce the level and cost of administration, the Council is not looking to reduce the total overall level of support available.

What is Council Tax Reduction?

Council Tax Reduction is a discount for Council Tax and it was previously called “Council Tax Support”. The level of discount is based on the income of the household. Currently the maximum discount is 82.5% of Council Tax for working age households, 95% for working age disabled & carer households and up to 100% for pensioners.

Why is a change to the Council Tax Reduction scheme being considered?

In April 2013, the Council Tax Benefit Scheme was replaced by a new Council Tax Reduction Scheme. Council Tax Benefit had been funded by the Department for Work and Pensions. It supports people on low incomes by reducing the amount of Council Tax they must pay.

The Council Tax Reduction scheme is determined locally by District Councils rather than the Department of Work and Pensions. Although the Government initially provided funding for the scheme, the funding has reduced each year

People can claim Council Tax Reduction if they are on certain benefits, or in receipt of a low income. The current scheme requires all working age applicants to pay a minimum of 17.5% of their Council Tax (a maximum level of support of 82.5%). Working age disabled & carer households pay a minimum of 5% of their Council Tax. Applicants in receipt of Jobseekers Allowance, Income Support and Income Rated Employment and Support Allowance receive the maximum level of support. Others receive a level of Council Tax Reduction based on their income and other factors.

A separate Central Government scheme is retained for people of pension age meaning that pension age claimants are not affected by changes to the scheme. Councils are only able to vary their schemes for people of working age.

All councils are required to review their Council Tax Reduction scheme each year. If they want to make any changes they must inform the public and gather views through public consultation.

Ashford Borough Council is proposing a number of changes to its existing scheme and, in line with legislation, we have a duty to consult you and provide you with the opportunity to tell us your views on the proposed changes to our Council Tax Reduction Scheme.

The Council is consulting on the following changes to its scheme for 2020/21 – these are explained in more detail later on:

- Introducing an income ‘grid’ scheme for all working age applicants replacing the current means tested approach which was based on the previous Council Tax Benefit scheme (Change 1);

- Limiting the number of dependent children used in the calculation of support to two for all working age applicants (Change 2);

- Changing the claiming process for all applicants who receive Universal Credit (Change 3);

- Removing the current earnings disregards and replacing them with a standard disregard of £25 (Change 4);

- Disregarding Carer’s Allowance which is currently taken into account as income (Change 5);

- Where the applicant is in receipt of Universal Credit, any amount awarded as a housing element will be disregarded when calculating the applicant’s income(Change 6);

- Decrease the maximum level of protection for working age claimants from 82.5% to 80%, and from 95% to 90% for working age disabled & carer households (Change 7);

- Remove the extended payments provision within the existing scheme (Change 8);

- Provide a further income disregard of £40 where an applicant, their partner or dependant child is in receipt of Carer’s Allowance or a disability benefit such as Disability Living Allowance or Personal Independence Payment (Change 9)

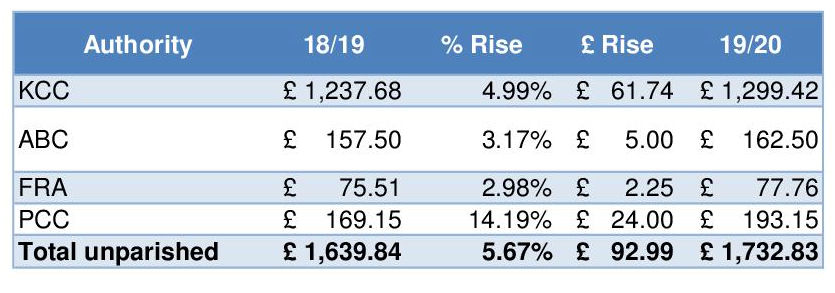

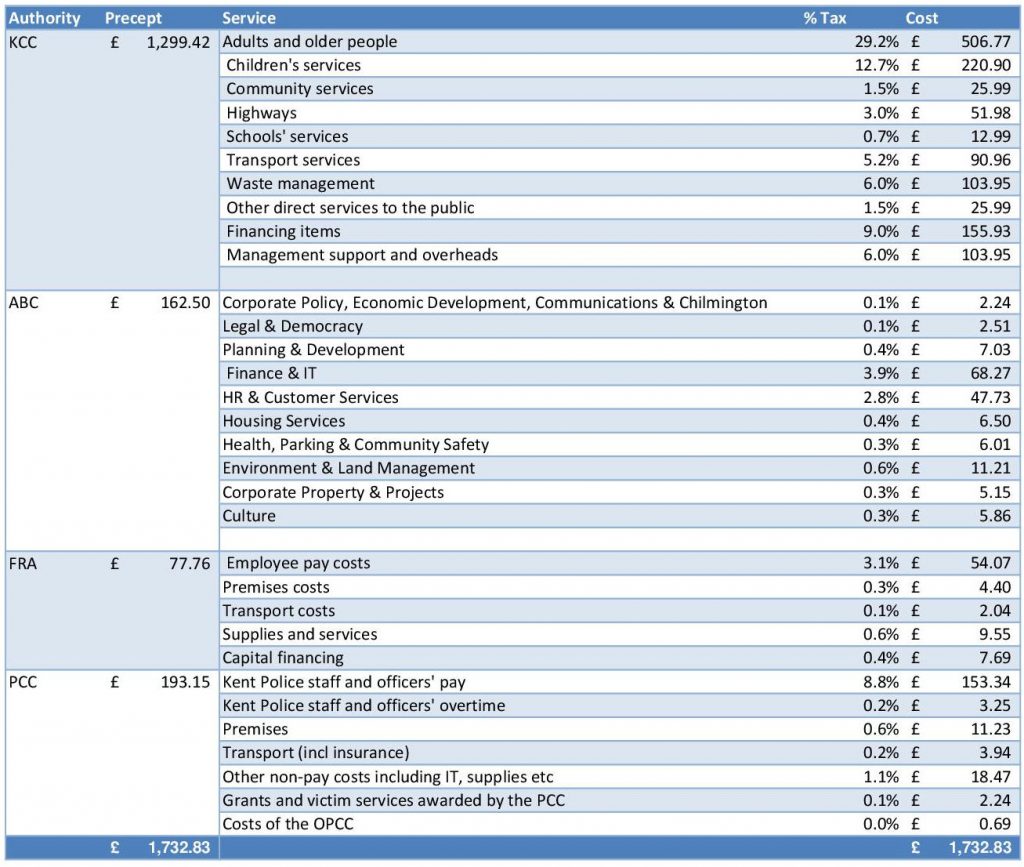

- Making all changes in circumstances which change any entitlement to Council Tax Reduction on a daily basis rather than the current (benefit based) weekly basis (Change 10);This scheme is estimated to affect 4,500 households in the borough. The gross cost of the scheme is £7.4 million which is spread across Ashford Borough Council (9%), Parish (3%), Kent County Council (73%), Fire (4%), and the Police (11%).

Who will this affect?

Working age households in the Borough who currently receive or will apply for Council Tax Reduction.

This will not affect pension age households.

Are there any alternatives to changing the existing Council Tax Reduction scheme?

We have also thought about other ways to make the process simpler. These have not been completely rejected (including maintaining the current scheme) and you are asked about them in the Questionnaire.

We have considered the following:

- Continuing with the current scheme

- Reduce funding to other Council services to pay for additional administration costs

- Use the Council’s reserves to keep the Council Tax Reduction scheme

Documents

Respond

Links